To resolve the flaw arising due to the inventory assumption, some companies use the number of units method to calculate the ITR instead of the monetary value of the same.

Therefore ITR in isolation doesn’t tell as much as it is advocated in the financial analysis industry A deeper look into the notes of the same is required because two companies may use a different inventory assumption so both need to be brought on the same page before comparing.

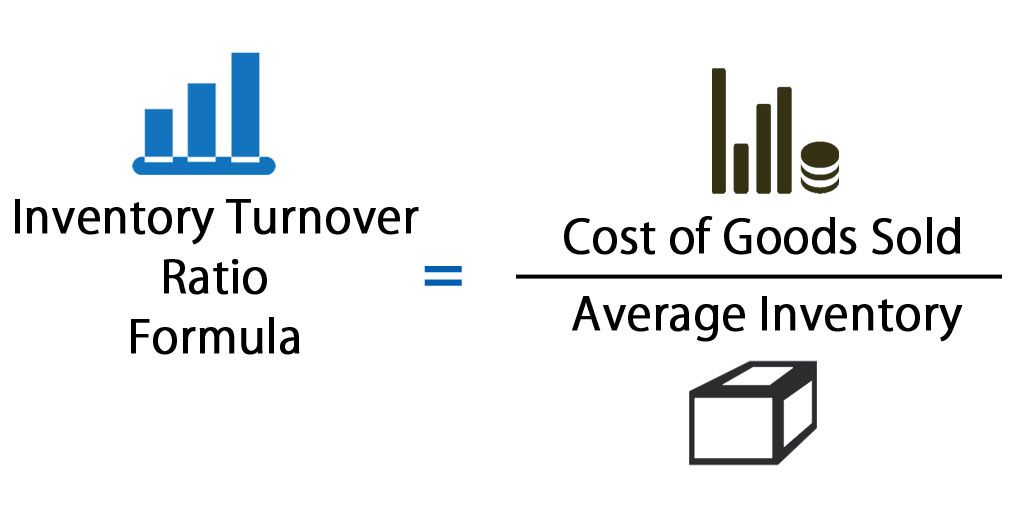

#Inventory turnover ratio upgrade#

Further, it may even signal obsolescence. Keeps an eye on the Efficiency of the Company: If the ratio is high it implies that the company is efficient in selling what it is producing but if the ratio is low, then it could point out to overstocking situation or an inefficient sales and marketing effort.

Had the denominator been higher than the numerator, it would mean an inventory pile-up or lower efficiency in the management of the same, which would need to be investigated further to find out the causes and rectify them. Inventory Turnover Ratio = $97,000.00 / $36,500.00Īs the inventory turnover ratio is greater than 1, it implies efficient management of inventory in the company.cash conversion cycle improved from 2020 to 2021 but then deteriorated significantly from 2021 to 2022.

#Inventory turnover ratio plus#

number of days of payables outstanding increased from 2020 to 2021 but then slightly decreased from 2021 to 2022 not reaching 2020 level.Ī financial metric that measures the length of time required for a company to convert cash invested in its operations to cash received as a result of its operations equal to average inventory processing period plus average receivables collection period minus average payables payment period. operating cycle deteriorated from 2020 to 2021 and from 2021 to 2022.Īn estimate of the average number of days it takes a company to pay its suppliers equal to the number of days in the period divided by payables turnover ratio for the period. number of days of inventory outstanding deteriorated from 2020 to 2021 and from 2021 to 2022.Īn activity ratio equal to the number of days in the period divided by receivables turnover.Įqual to average inventory processing period plus average receivables collection period. An activity ratio equal to the number of days in the period divided by inventory turnover over the period.

0 kommentar(er)

0 kommentar(er)